With the largest ever one-day price drop in the Dow of 1,175 points on February 5th, 2018 and market volatility finally creeping back into the public markets after being absent for almost eight years, some investors are wondering if their investment allocation will weather the future.

It is easy for investors to become complacent when markets are skyrocketing, but when the markets turn negative for no well-understood reason, investors inevitably question their decisions and allocations.

The fact is, market volatility is good for the investment markets and good for investors’ returns. It weeds out the weak investments and it allows entry into new investments that can propel those investments forward. Corrections have always been a part of investing in public markets, and we were long overdue.

For those that were over-allocated to one sector or too-allocated to the public markets and are now reconsidering a strategy for going forward, trimming from gains, rebalancing, and investing into other asset classes or sectors that are not overpriced and still considered a good buy may make sense.

2018 has a lot of changes to contend with, including tax reform, interest rate increases, a mid-term election, and geopolitical issues around Russia and North Korea to name a few. To diversify away from the public markets, investors are looking to private markets to help reduce volatility, increase diversification and enhance returns.

The two main options qualified investors have is to go into private equity and private real estate. In 1996, there were 7,322 listed companies on the NYSE and Nasdaq. As of 2017, there were 3,671 – a decline of almost 50%. There are fewer companies seeking an IPO – down 66% from historical annual averages, and more private companies are staying private. The private companies who may have considered an IPO as their only exit strategy in the past are now either purchased by larger private companies or larger public companies. That alone has many investors transferring assets away from public markets to seek diversification as the public markets now provide much less coverage of our entire economy than before (Economist, April, 2017).

While private equity is one option, many investors choose private real estate for its historic stable values and long-term appreciation in value, cash flow opportunity, tax write-offs, depreciation, and as a hedge against expected inflation. As of 2017, the aggregate US stock market value was approximately $26 trillion, and the global equities market value is now over $76 trillion according to Bloomberg’s World Exchange Capitalization Index – the highest ever. That said, global real estate’s total value as of 2016 was over $217 trillion, or 60% of the entire world’s investment value, including all equities, bonds/debt, and gold. Approximately 75% of this global real estate value is in residential homes, leaving $29 trillion in commercial real estate value and an additional $26 trillion in agriculture and forestland value (Barnes, Savills World Research, 2016).

So, is now the right time to invest in farm and ranchland as an investment?

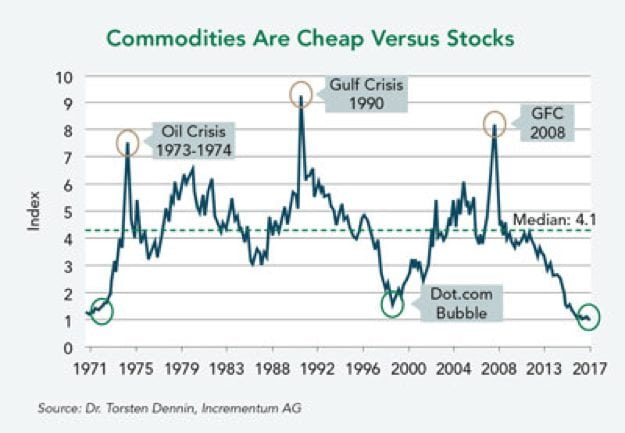

In a recent January 1, 2018 article by LandOwner Editor, Mike Walston featured on AGWeb.com, he shows the below chart depicting the relationship of the S&P 500 Index against the Goldman Sachs Commodities Index (GSCI).

© Dr. Torsten Dennin, Incrementum AG, LandOwner

This is the lowest the GSCI has been in over 50 years compared to public equity prices in the US, and why many investors consider farmland a value buy today.

This data does not necessarily suggest that we are heading for another “Great Recession” or that the public markets will crash. However, value investors, in theory, attempt to buy what is cheap and sell when prices are high. What is clear from this data is that commodities prices are a value buy when compared to equities – and current farmland real estate prices should eventually reflect this opportunity and react to commodity prices.

Reading the tea leaves, as the population continues to grow, global middle-classes expand, and demand for global commodities and consumer staples increases, commodities prices should increase over time, making current investors in agriculture happy well into the future, all while providing diversification away from the public markets.